FS25E - Postage non-EU

Category : Fact Sheets

FS25E - Postage non-EU

Letters/documents:

Sending letters and documents remain as it is, without any extra process. In terms of tariff, the UK is still under the tariff for Europe. Tariffs can be found HERE.

Packages sent from Portugal to non-EU countries :

Private:

You can purchase international envelopes and packages for shipping from CTT online or in the shops (details HERE).

All packages sent to countries outside of the European Union (Extracommunitário) must have a “pré-aviso” (Criar envio de Correio International) done online on the CTT website.

You do not need to have a personal login to the CTT website to fill in this form but if you wish to have one, it can be done, and you will then be able to follow your history of packages sent since your login was made.

The form to fill in online is in Portuguese and you must fill in details about the package, such as the mail type, destination country, number of objects, weight, format, content, information about the sender and the destination plus a customs declaration:

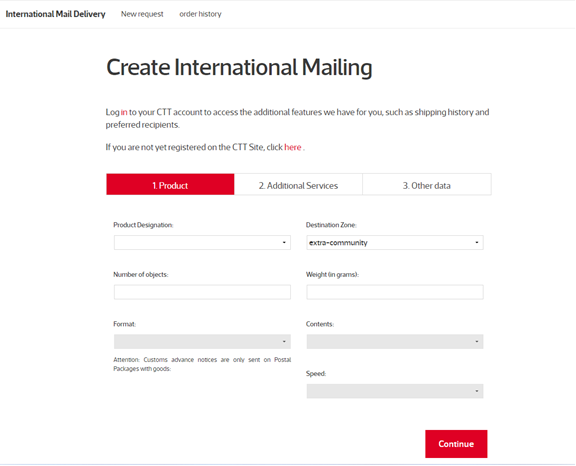

The first step is 1. Produto (Google translation below):

You fill in the required fields with just general information .

In the drop-down box of Destination Zone, you choose Extra-comunitário if you want to send to non-EU countries.

Click CONTINUAR

The 2nd step is Serviços Adicionais (this will skip automatically)

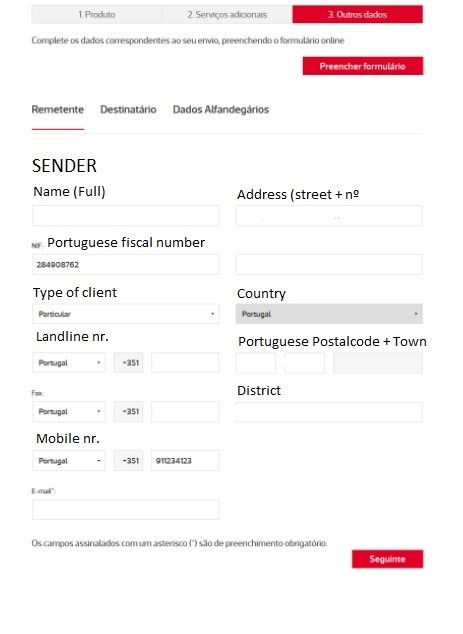

The 3rd step is Outros Dados where you need to click on PREENCHER FORMULÁRIO

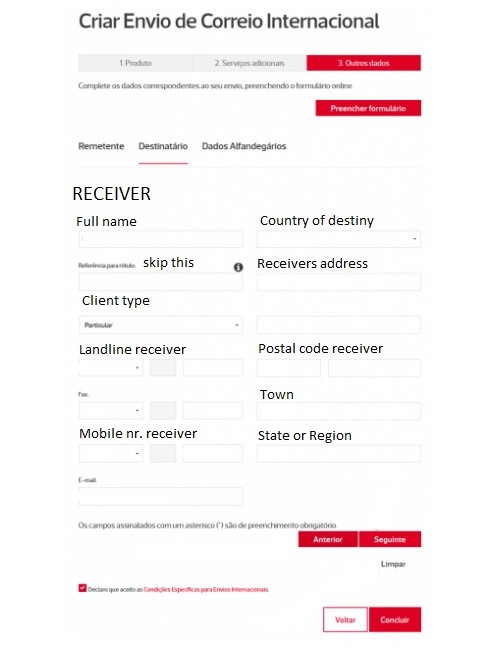

Tick the box where you agree to the conditions DECLARO QUE ACEITO …

Fill in the Form- * are required fields.

You start with the REMETENTE (Sender) details:

Click on SEGUINTE when you are finished

You come to the next page which is DESTINATÁRIO (Receiver)

You fill in the details. If you like to clear all the form you can press at the bottom LIMPAR

If you like to return to the previous page you click on ANTERIOR

After completing the form, you click on SEGUINTE

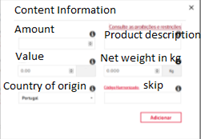

The next form is for the Customs. Choose in the CATEGORIA DE ENVIO: Oferta (gift) and click ADICIONAR CONTEUDO

The following pop-up screen will appear. You need to fill in the details for each product you are sending:

Press ADICIONAR when you are finished.

If you need to add more items, click again on the ADICIONAR CONTEUDO button, and repeat the process until you have done them all. After you have finished adding, you can click on CONFIRMAR.

And finally click on CONCLUIR.

At the end of filling in the pré-aviso, you should print the proof with the bar code and attach it to the package, it can then be sent from the post office. It is important that that proof has the “nº de envio” and all other details (sender/destination etc.)

If you do not have a computer to fill in the pré-aviso, then the post office can do this for you, it has a cost of around 4 euros. It may be though, since this is new (introduced 1st of January 2021), that your local post office is not completely set up for this yet.

If you are sending a present to a private person, it is important to keep the fatura/receipt with you because the customs in the country of destination may require seeing that.

Commercial:

If you purchase an item from a company online to send to someone private abroad (non-EU), it is important to know that each country can have different rules about IVA and customs taxes, for instance in the UK – if the item has a value of over 39.00 Pounds, the person receiving it will be required to pay IVA and customs taxes.

Packages sent from non-EU countries to Portugal:

Private:

Private people sending packages from abroad to private people in Portugal must also check if their country requires for them to do a similar “pré-aviso”. In Portugal any package from a non-EU country will be stopped in the customs and the receiver will be contacted (either by SMS, email, or post) to do the customs release (Desalfandegamento). See below further information about that process.

Commercial:

From 1st of July 2021, all purchases that enter Portugal, regardless of the value of the object and the date on which it was purchased, will be subject to paying IVA and must go through customs clearance. (Prior to 1st of July 2021, if someone purchased an item from a company online, and if the item had a value under 22.00 euros, the person receiving it wasn´t required paying IVA (23%) and customs taxes here in Portugal).

The customs clearance process and the arrival of the order will depend on what you are asked to pay at the time of your online purchase. If there is information missing, you will be contacted by CTT with an object number. This you need to fill in on the CTT website. The customs release process needs to be completed on the CTT website or follow the link that has been sent to you by e-mail. You will need to have a personal login to the CTT website in order to start the procedure of “Desalfandegamento”. If you do not have this, then choose “Criar Conta” or “registe-se aqui”. Under Registo Pessoal (for private persons) you can fill in the personal details, making a password and submitting, you will receive an email from CTT where you must confirm the activation of your login – choose the link “clique aqui para ativação”.

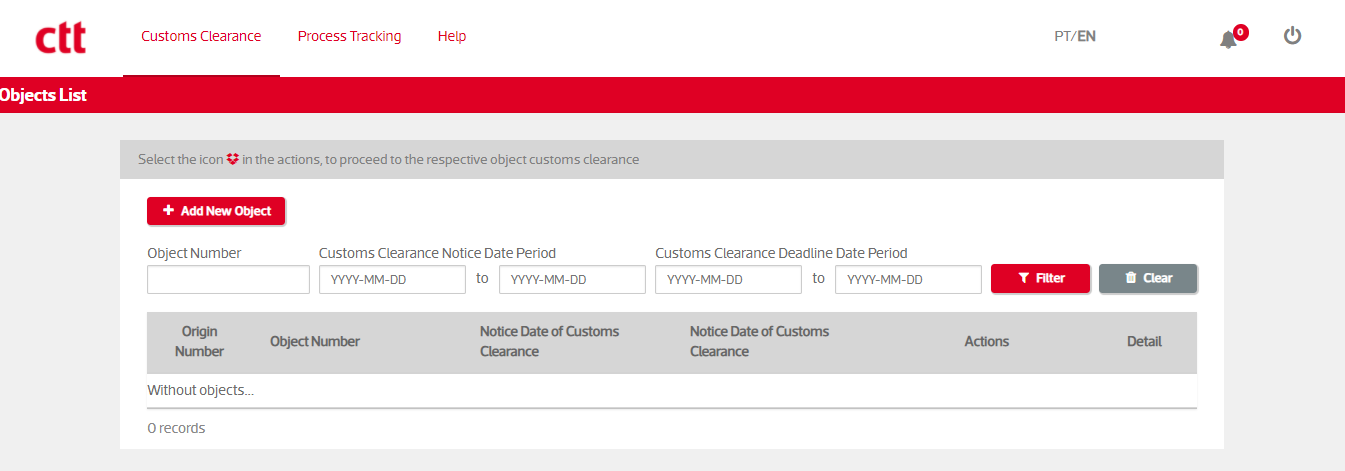

Once you have logged in successfully with your email address and password, go to “iniciar processo/start process”. If you fail filling in the object number in the box or there is nothing filled in yet on the line below, just click on the red button + Add New Object and fill in the object number. Click on “Avançar” to go to the next step.

You will then see that the information that CTT already has from the sender will automatically be filled in and you simply have to fill in any missing information. Make sure you take a print screen of the website where you place the order, keep a copy of your proof of payment and the invoice of the goods as you might need to upload this on the CTT website for the Desalfandegamento. If they ask for this information, you will need to upload these on the next step 3. An instruction video in Portuguese you will find HERE.

After uploading the documents (not bigger than 2MB) click on “Avançar” again you will get to the summary page. Page 5 will give you details for payment for the Custom Clearance.

The amount declared needs to be the same as on the invoice. If it is not in Euros, you will need to fill in the correct currency and amount. There is a converter on the website that will change the value automatically.

Purchases on sites that charge, in addition to the value of the good, all import charges (IVA and CTT Services) upon arrival in Portugal, the order is cleared through customs without requiring any intervention from you or any additional payments.

Purchases on sites that only charge the value of the item you will be notified, as soon as the order is shipped from the country of origin, to start the customs clearance process on the CTT website, and to pay the IVA and CTT Service charges (as well as any customs fees for orders above 150.00 euros) which can be done straight on the website.

Purchases on sites that charge the value of the goods and IVA, but do not charge the CTT Service Until 12/31/2021 there will be no payment for the CTT customs clearance service. So, upon arrival in Portugal, the order is cleared through customs without any payment or intervention by the recipient being required. However, after 1st of January 2022, there will be CTT Service fee to pay.

Please be aware that there are some territories of the European Union which, for tax purposes, are considered to be non-EU and are therefore subject to customs control and IVA payment. For tax purposes, the country of origin of the shipment should be considered and not the country of the online store.

Territories of the European Union which are not part of the tax and customs union:

Andorra (Spain)

Buesingen (Germany)

Canary Islands (Spain)

Ceuta (Spain)

Heligolândia (Germany)

Aland Islands (Finland)

Faroe Islands (Denmark)

Lake Lugano (Italy)

Livigno (Italy)

Melila (Spain)

Mount Atos (Greece)

For more details please click HERE.

Packages with prescribed medication sent from non-EU countries to Portugal:

Is it illegal to send prescribed MEDICATION from a non-EU country (including UK) to Portugal?

The answer is that it is NOT illegal but there is a certain procedure in place:

The package will be stopped in customs. The medicine in the package will be sent to INFARMED (Portuguese authorities for medication) for approval of entering Portugal, the package receiver will get a letter by post from the customs informing them that this process has been started (approval by INFARMED).

If it is NOT approved, the package will be returned to the sender (no charges) but the receiver will NOT be informed about that, it will just happen automatically.

If it IS approved, the receiver will either simply get the package delivered or be contacted by customs again to proceed with the “desalfandegamento”.

Customs release - packages from PRIVATE to PRIVATE – desalfandegamento online :

The customs release process needs to be completed on the CTT website. You can start by changing the language to English in the right-hand corner (Idioma). In the “Ferramentas/tools” area choose “Desalfandegar uma encomenda/customs clearance”. You will need to have a personal login to the CTT website in order to start the procedure of “desalfandegamento”. If you do not have this, then choose “Criar Conta” or “registe-se aqui”. Under Registo Pessoal (for private persons) you can fill in the personal details, making a password and submitting, you will receive an email from CTT where you must confirm the activation of your login – choose the link “clique aqui para ativação”.

Once you have logged in successfully with your email address and password, go to “iniciar processo/start process”.

You will then see that the information that CTT already has from the sender will automatically be filled in and you simply have to fill in any missing information. Once that is done and you have indicated it is a non-comercial package, the next step will be to determine if there are any CTT service fees to be paid. If yes, the process will end with giving you the amount to pay. The payment details (entidade/referência/valor) to pay by multibanco or online banking (Portuguese bank) are in most cases sent to you by email. Once you have done the payment, the package will be released by the customs.

If during the process you have any doubts, go to the top menu and choose “ajuda/help” and you will find information and help to finish the process. However, even if you have chosen the language to be in English, the help FAQ’s are only shown in Portuguese (you could try to use the translator tool on your internet browser for instance).

In some situations, even if the sender has informed in detail what is in the package, you might still need to specify this further in order to determine the “código harmonizado”. For instance, if someone sent you a jumper, you should choose clothes (“vestuário”), which will then lead to further questions about what kind of clothes, what kind of material etc. If you have problems with this procedure, you can contact the CTT information help line for assistance, see contacts below.

Código Harmonizado: Also called HS Code which is the abbreviation for Harmonized Commodity Description and Coding System. This is a list of numbers used internationally by customs to classify a product and is used to define the duties and fees payable. An HS code is also known as a harmonized code, tariff code or commodity code.

Good tips to make the customs release in Portugal easier (obtained from CTT help line):

Inform your friends and family in non-EU countries that if they send packages to you in Portugal, they should make sure that they give as much information as possible when sending (depending on the country it is sent from: by filling in a form online/filling in a form at the post office/giving information to the post office staff)

For instance: receivers: name, address, email, mobile number, package content: what it is, material, number of items, content value: value of each item in the package, postage value: value paid for sending the package.

Inform your friends and family in non-EU countries that if they send presents, to keep all receipts that prove they paid IVA in the country of purchase, in case you are asked to prove that. Furthermore, they could send you an email saying that they have posted a present to you (no need to go into details about what it is) in case you are asked to prove that your package is indeed non-commercial.

If the sender adds your email or Portuguese mobile number, the CTT will contact you that way with information to start the customs release. That way is quicker than waiting to get the information by post, which is the procedure if CTT does not have a mobile number or email address.

CTT INFORMATION HELP LINE

The CTT information line is available to answer questions about the process and give further information (also to confirm if a package has been returned to sender): 210 471 616 (press 1 for English).