FS36E - Fiscal Representation

Category : Fact Sheets

FS36E - Fiscal Representation

Who needs a Fiscal Representative in Portugal

People (non-Residents) who have an address outside the EU or Schengen registered with Finanças AND who have a fiscal relationship with Portugal:

If you own a property or a vehicle in Portugal

If you have income from employment or self-employment

The reason for needing a Fiscal Representative is that Finanças do not post correspondence outside of EU/Schengen and will need a representative here in Portugal who can receive your correspondence and make sure you comply with declarations, payments and any other instructions from the Finanças etc. This representative can be anyone who has a fiscal number in Portugal and who IS a Resident here or it can be an accountant/document agency/lawyer etc.

However, a new law was introduced in Portugal (Decreto-Lei 44/2022) which dispenses the need for a Fiscal Representative if you activate the new system of electronic notifications and citations (notificações e citações eletrónicas) on the Finance Portal (Portal das Finanças). This law came into force on the 9th of July 2022. This Fact Sheet was created to give further information about this system and the process of activating it on Portal das Finanças. You will need your NIF (Fiscal number) and your personal password for Portal das Finanças. If you do not already have that password, you must apply for it. Please see our Factsheet FS30 – Applying for a Finanças password.

Important information to be aware of if you decide to activate notificações e citações eletrónicas:

If you have already presented a Fiscal Representative, you will need to officially cancel that, it will not happen automatically when you activate notificações e citações eletrónicas. After activating notificações e citações eletrónicas you will have to cancel the representative with Finanças which can be done through e-balção on Portal das Finanças. Further below you will find instructions on how to cancel the representative online. You can also cancel the representative by going to the Finanças office in person. After the cancellation is successfully done, you can contact your Fiscal Representative and dismiss them of their duties (in person, by email or registered letter).

If you are a Resident in Portugal but move away to a non-EU/Schengen country (but still have fiscal ties to Portugal), you will need to either present a Fiscal Representative or activate the notificações e citações eletrónicas. If you choose the notificações e citações eletrónicas (or if you already have this activated) then you will need to inform the Finanças of your change of address, pointing out that you have activated the notificações e citações eletrónicas. This way you are exempt from presenting a Fiscal Representative. The change of address can be done in person at a Finanças office or through e-balcão on the Portal das Finanças.

How to activate the notificações e citações eletrónicas on Portal das Finanças

Access the Portal das Finanças with the respective credentials (Fiscal Number/NIF and Password/ Senha)

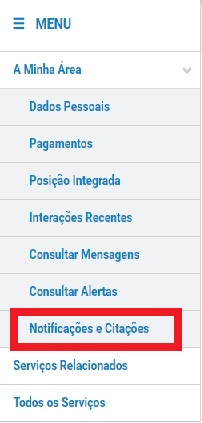

Once logged in, on the top dark blue bar you will find “A minha Área”, click that and on the next page in the MENU you will find Notificações e Citações

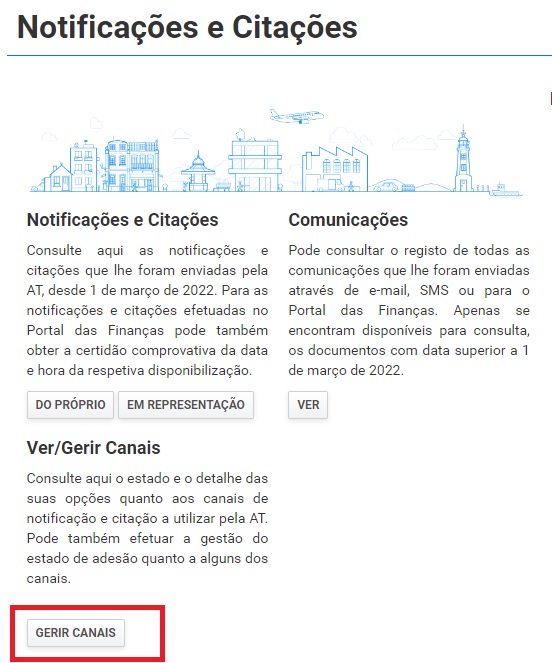

On this next page click on Gerir Canais

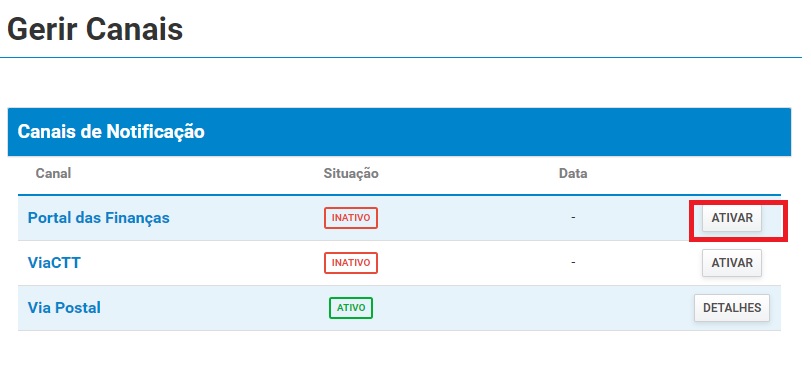

On this next page, under Canais de Notificação - Portal das Finanças – click Ativar

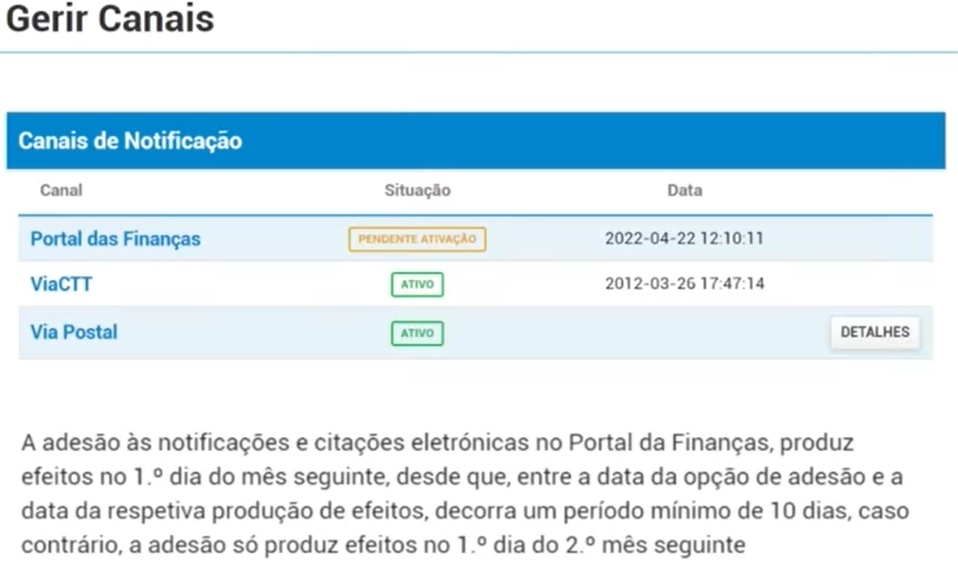

On this page you need to agree with the Terms and Conditions for the notificações e citações eletrónicas and to activate click Ativar

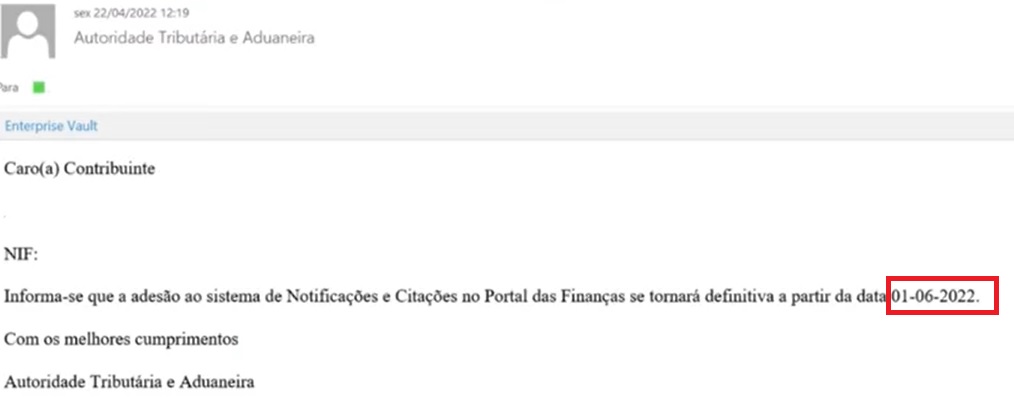

The process is now in the state of “pending activation”. The activation takes effect on the 1st day of the following month, provided that there is a minimum period of 10 days between the date you apply and the date on which it takes effect, otherwise, the activation will only take effect on the 1st day of the 2nd month following.

You will get an email from Finanças confirming the application and telling you the date it will be activated.

Once it is activated, the tax payer is responsible for checking if there are notifications (correspondence, tax bills etc.), you will not be informed when there is “mail” for you, you have to check on a regular basis on the Portal das Finanças here:

The system of notificações e citações eletrónicas applies only to administrative communications and notifications, as well as to citations produced in tax enforcement proceedings, originating from Finanças. It does not apply to court notifications and summons (people with ongoing court cases with Finanças).

Failure to appoint a fiscal representative or activate notificações e citações eletrónicas, consequences?

Failure to appoint/activate, when mandatory, is punishable by fine from € 75 to € 7,500.

Cancelling a Fiscal Representative on the Portal das Finanças

As mentioned earlier, the cancellation can be done in person at a Finanças office or through e-Balcão on Portal das Finanças. Access the Portal das Finanças with the respective credentials (Fiscal Number/NIF and Password/Senha). Once logged in, scroll to the bottom of the page and click on contacte-nos.

On this next page under Atendimento e-balcão click Aceder

The picture below shows the page you will see and what you should fill in. Make sure to fill in the Mensagem square with your request to cancel your Fiscal Representative and once that is done, click on the blue icon Registar Questão. It is also possible to attach a file if needed under Selecione o ficheiro a enviar.

The Fiscal Representative is NOT cancelled immediately once you have sent the request, you must wait for a reply from Finanças confirming that the Fiscal Representative was cancelled. This reply is posted to you on the Portal das Finanças, meaning you must remember to login and check for the reply.

The reply can be found the same place as where you started the request, so contacte-nos, then Atendimento e-balcão – Aceder. Once on that page you will see the request has been registered (Interações Registadas) and once the “Estado” has a green square that says “CONCLUÍDA” you can open and see the reply from Finanças (click Ver Pedido).

SOURCE: Autoridade Tributária Finanças