M03E - Car Tax (IUC)

Category : Motoring

M03E - Car Tax (IUC)

This tax is payable each year on each motor vehicle that you own and can be done between the first day of the month prior to the month of registration and the end of the month of the Portuguese registration.

You must pay IUC when you buy a new car or import a used one for the first time within 90 days of the date of the Portuguese registration.

The rules for calculating the amount of IUC payable for used imports changed in 2020. If the first registration was in an EU or EEA country (Iceland, Liechtenstein, Norway), it is the date of that registration that must be considered when calculating the IUC.

Meaning that imported used cars, whose first registration was in an EU/EEA country, pay IUC according to the date of that first registration and not according to the date of the Portuguese registration.

Imported used cars whose first registration was not in an EU/EEA country, continue to pay according to the date of their Portuguese registration - which includes Switzerland.

From 2026, the IUC tax will no longer be paid in the month of registration, but will be paid in February, in the case of amounts up to 100 euros. If the amount is higher, the owner will be able to pay half in February and the rest in October. The person that owns the vehicle on the 31st of December of the previous year will be responsible for the payment.

You will need both your Car documents (See Bulletin M/06/E) and your fiscal number and Identification (See bulletin P/01/E). At the Treasury in your local Finanças you will provide these documents and may pay your tax and receive your receipt (the stamp to put in your car window will no longer be provided and only a proof of payment is necessary) or you can do it online through the Finanças portal portal (see further down for the instructions).

The amount of tax varies according to the cubic capacity of the engine (CC) and for cars registered after 1st July 2007 the CO2 emission will also be taken into account. New cars purchased in Portugal will have the CO2 emission stated in their specifications and imported cars will be subject to a technical inspection which will determine the CO2 emission.

The CO2 test – called the New European Driving Cycle (NEDC) – was designed in the 1980s and became outdated and the European Union has therefore prepared a new test, called the Worldwide Harmonised Light Vehicle Test Procedure (WLTP) that applies from September 2017.

Before September 2017, all cars at dealerships had CO2 values based on the old NEDC test (the New European Driving Cycle).

During the period of transition from NEDC to WLTP that started in September 2017, cars approved before then will continue to have CO2 values as measured under the NEDC test only.

However, when a new car type is certified under WLTP after September 2017, its official vehicle documents (the Certificate of Conformity) will have CO2 emission values from both the new lab test as well as the old one.

From 2020 all new cars must have WLTP-CO2 values

Exclusively electric passenger cars are exempt from IUC - this exemption does not cover hybrids or plug-in hybrids, which pay the normal price like any other car.

The payment of the car tax can be done via Finanças. In order to do this you will need to request a password (pedir senha) on the same site. Only after you have this password you will be able to enter your private file and pay your tax.

Please find further below information on how to pay this tax online.

The following tables give you the rates for 2024 and remain unchanged for 2025.

Table of Tax for vehicles matriculated before the 1st July 2007:

Fuel Type | Year of Matriculation | ||||

| Petrol cm3 | Others cm3 | Elec. Watts | After 1995 | 1990-1995 | 1981-1989 |

| Up to 1000 | Up to 1500 | Up to 100 | €19.90 | €12.55 | Exempt |

| 1001-1300 | 1501-2000 | Over 100 | €39.95 | €22.45 | €12.55 |

| 1301-1750 | 2001-3000 | - | €62.40 | €34.87 | €17.49 |

| 1751-2600 | Over 3000 | - | €158.31 | €83.49 | €36.09 |

| 2601-3500 | - | - | €287.49 | €156.54 | €79.72 |

| Over 3500 | - | - | €512.23 | €263.11 | €120.90 |

* When the IUC is less than €10.00 there is a waiver of payment (Article 16, paragraph 6 of the IUC Code).

Diesel additional tax for vehicles registered before 1st of July 2007:

Year of Matriculation | |||

| Engine Power (cm3) | After 1995 | 1990-1995 | 1981-1990 |

| Up to 1500 | €3.14 | €1.98 | €1.39 |

| 1500 - 2000 | €6.31 | €3.55 | €1.98 |

| 2000 - 3000 | €9.86 | €5.51 | €2.76 |

| Over 3000 | €25.01 | €13.19 | €5.70 |

Vehicles matriculated from the 1st of July 2007:

Engine Power (Cm3) | Tax | CO2 emissions (grams by Km) | Tax | From 2018 Tax | |

NEDC | WLTP | ||||

| Up to1250 | €31.77 | Up to120 | Over 140 | €65.15 |

|

| 1251-1750 | €63.74 | 121 - 180 | 141 - 205 | €97.63 |

|

| 1751-2500 | €127.35 | 181 - 250 | 206 - 260 | €212.04 | €31,77 |

| Over 2500 | €435.84 | Over 250 | Over 260 | €363.25 | €63,74 |

Vehicles matriculated in Portugal after the 1st July 2007, will have a CO2 component on their annual tax, to find out what your tax is from the table above you must add the tax relating to the engine power to the tax related to the CO2 component.

As an example, we took a 2.000cc, registered in Portugal on 21st July 2019, with a CO2 emission of 142: CC tax €127,35 + CO2 tax €97,63 = €224,98 x 1.15* = IUC €258,73

There is an addition to this tax, a coefficient according to the year of matriculation in Portugal:

- Cars from 2007 - Coefficient of 1.00

- Cars from 2008 - Coefficient of 1.05

- Cars from 2009 - Coefficient of 1.10

- Cars from 2010 onwards - Coefficient of 1.15

Diesel additional tax for vehicles registered after 1 July 2007

Engine Power (cm3) | Tax |

| Up to 1250 | €5.02 |

| 1251 to 1750 | €10.07 |

| 1751 to 2500 | €20.12 |

| Over 2500 | €68.85 |

Motorcycles, mopeds, tricycles and quadricycles (cat. E)

Engine Power (cm3) | Matriculated | |

| 1997-2025 | 1992-1996 | |

| Up to 120 | Exempt | Exempt |

| 120 to 250 | Exempt | Exempt |

| 251-350 | Exempt | Exempt |

| 351-500 | €21.18 | €12.53 |

| 501 -750 | €63.62 | €37.47 |

| Over 750 | €138.15 | €67.76 |

Last change: º 82/2023 - 29/12

OE2024

Instructions on how to obtain the document to pay your car tax from Finanças website.

Paying Car Tax via the Finanças website.

Follow the link above to go to the website.

Follow the steps marked below to pay your car tax online:

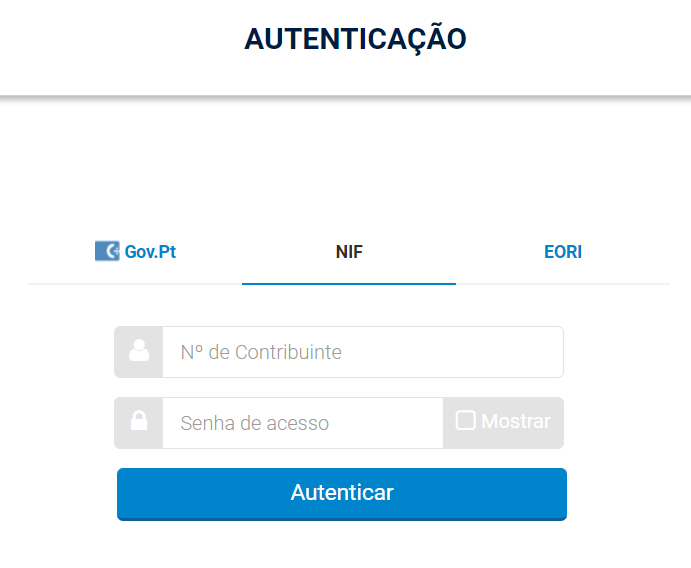

Click on Iniciar Sessão (if you do not yet have a password for the website, you must first register with Registar-se - how to do this can be found in our Factsheet FS30)

Click on NIF and you will get to the screen to log in using your fiscal number (NIF - Nº de Contribuinte) and your “Senha de Acesso” (Password) into Finanças website:

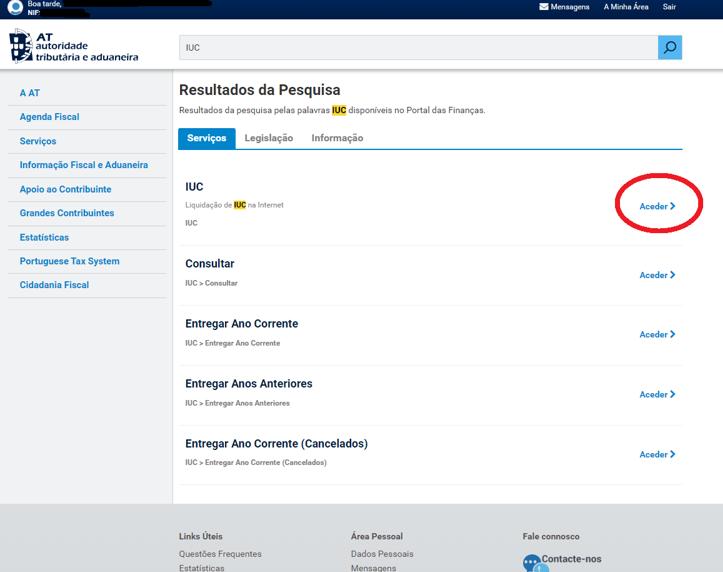

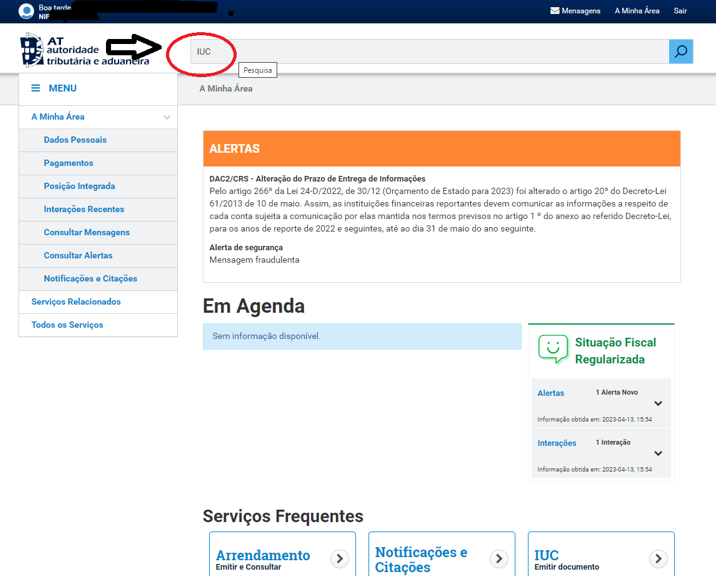

In the search field you type “IUC” and press ENTER

Choose the option “IUC” and click in “Aceder”

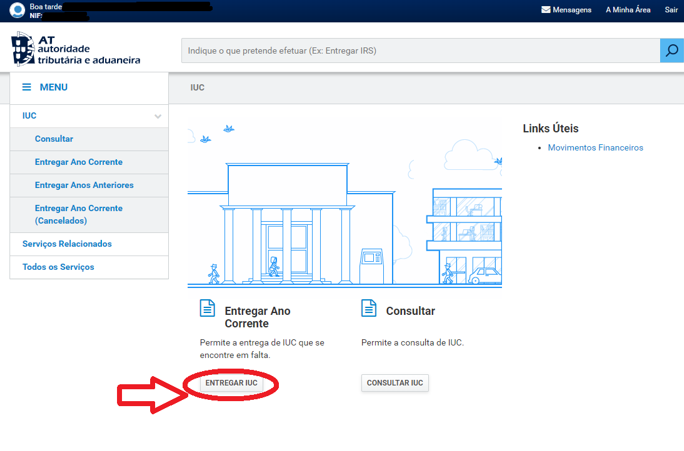

Then click in “ENTREGAR IUC”

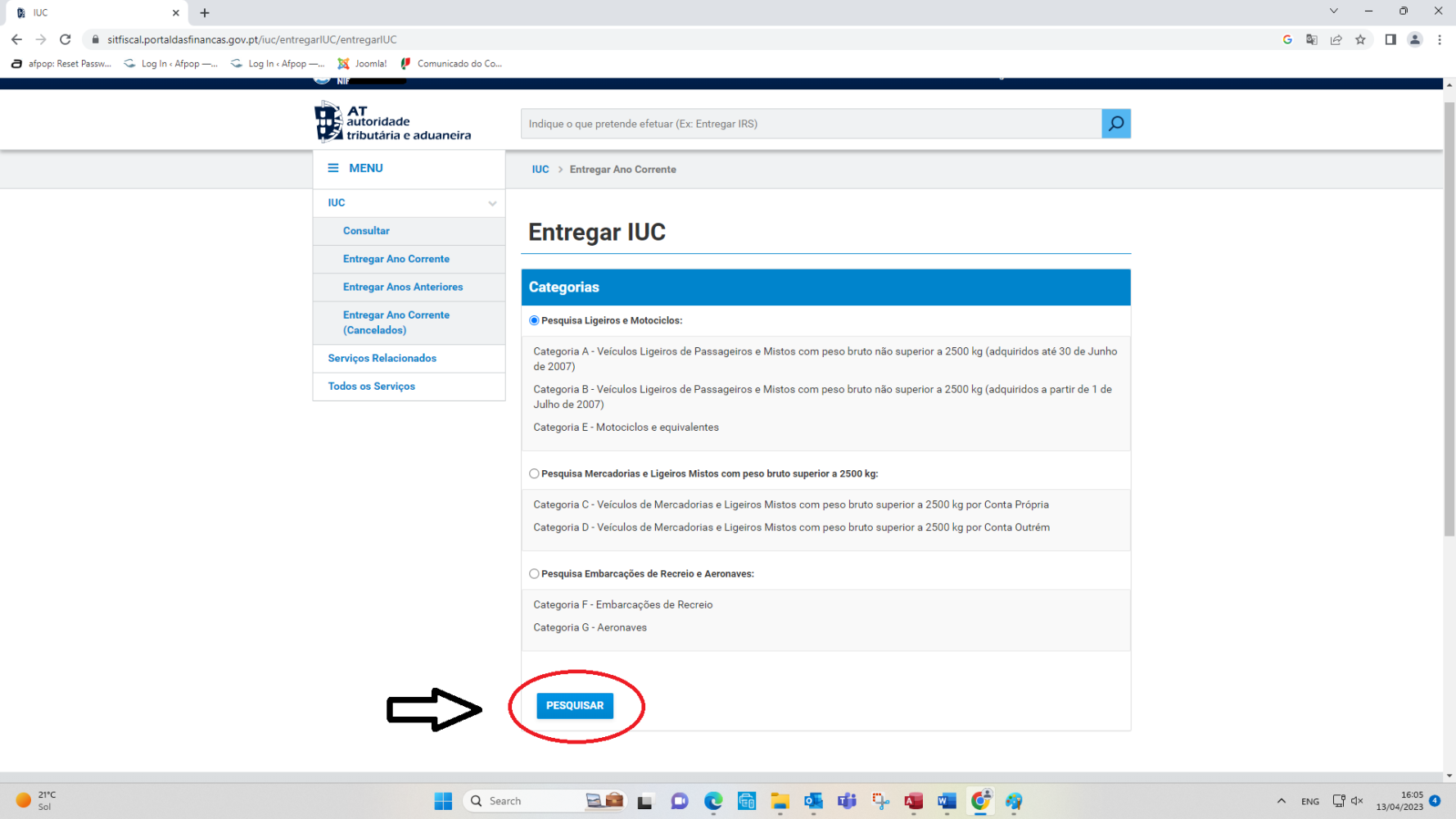

A new window appears with some options. The first option in this window refers to passenger vehicles and motorcycles. The second option refers to commercial vehicles and mixed vehicles over 2500kg. The 3rd refers to private boats and planes. Tick the box that applies to your and click on ‘Pesquisar’:

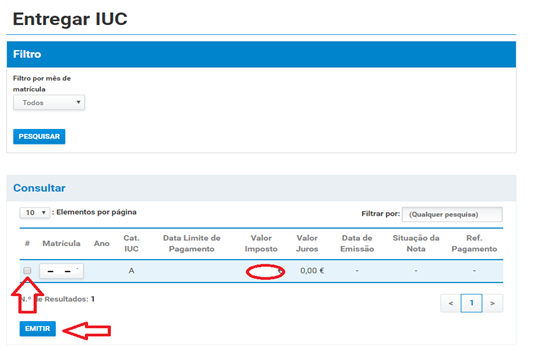

You will then be presented with the details of the vehicles which Finanças have on record as being owned by you. Scroll down to ‘Consultar’. Tick the box which applies to the vehicle which you wish to apply for and click on the button marked ‘Emitir’.

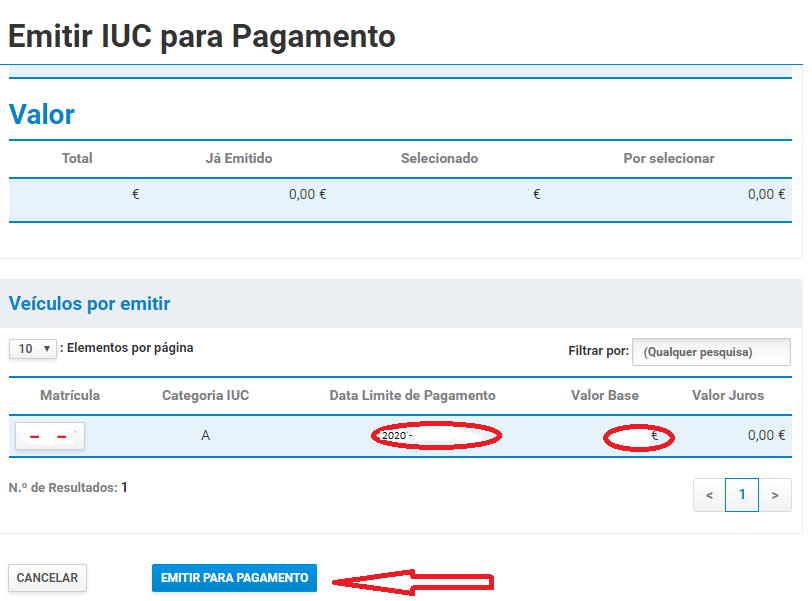

Again scroll down on the next page and click on ‘Emitir para Pagamento’ to obtain the payment details

If you are sure you want to get the payment details you click again on ‘Emitir’ on the next screen

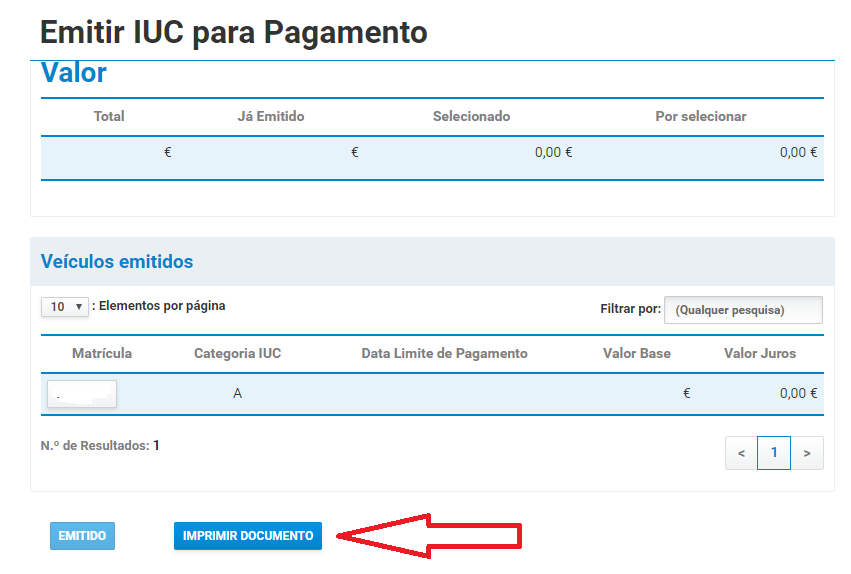

You now get to the screen where you can print the payment details. Click on ‘Imprimir Documento’

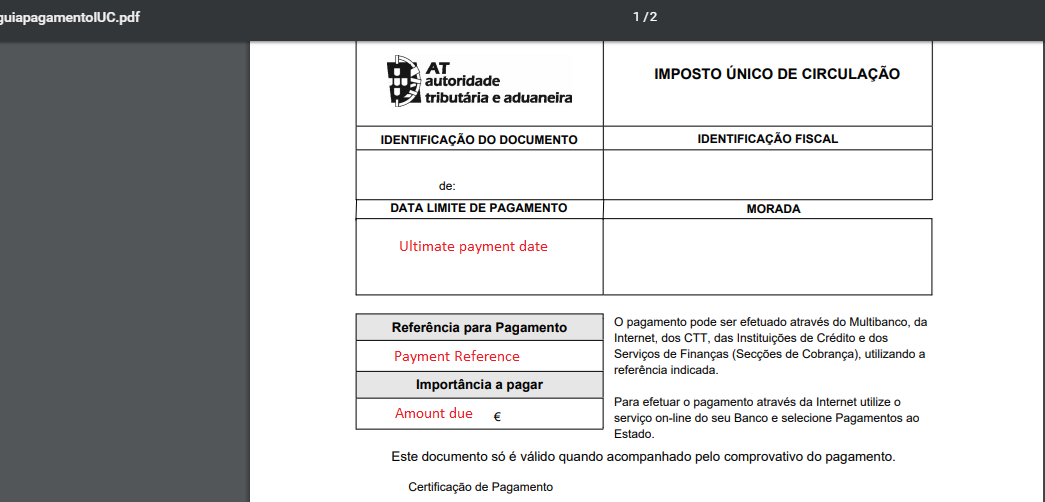

This will then provide you with the PDF document with payment details.

You can pay by Multibanco, Internet banking, and of course by post (CTT) or at Finanças. If you choose to pay by Multibanco or Internet banking, you will need to use the number in the box marked ‘Referência para Pagamento’ and if you pay by post or at Finanças you should provide copies of the PDF for their reference

Multibanco payments

Print a copy of the Payment Certificate which was presented in PDF, so that you have the payment reference with you. At the Multibanco machine select Pagamentos and follow the instructions on the screen, choosing the ‘Pagamentos ao Estado’ option and then insert the number stated on the PDF form.

Internet banking

If you choose to pay by internet banking, in the box marked ‘Tipo Pagamento’ select ´Pagamentos ao Estado’. If the drop down menu does not yet give you ‘IUC’ as an option, as for example with BPI Internet Banking, choose ‘Outros Impostos’ which should take you to the required section and ask for the type of payment you wish to make, which is Imposto Único de Circulação. This is where you will need the reference number from the PDF form.

If you are abroad and do not work with online banking for your Portuguese bank, you can pay the IUC by bank transfer. Below is a section from the Portal das Finanças that explains how to do that:

If you go for bank transfer, please provide your bank with the information set out below so that the bank, when carrying out the transfer, can send such information to the Tax Administration, as it is essential for the identification of the payment:

• TIN: 600 084 779

• Name of the creditor: Autoridade Tributária e Aduaneira

• Bank account number: 83 69 27

• IBAN: PT50 0781 0019 00000008369 27

• Bank name: Agência de Gestão da Tesouraria e da Dívida Pública – IGCP, E.P.E.

• Swift code: IGCPPTPL

• Your tax identification number - NIF - contained in the payment document

• And the reference for payment: Each reference corresponds to a specific number for payment, which is set out in the document.

Please note:

• You must make a bank transfer for each payment document.

The payment is recommended to be made at least 2 working days before the deadline.